Transparency and decentralization of the crypto exchange without third parties has always been one of the main goals of blockchain technology.

As of today, however, the situation is the opposite: most of the top crypto exchanges are centralized.

At the recent “TechCrunch Sessions: Blockchain” conference founder of Ethereum Vitalik Buterin said:

Despite the audience reacting with laughter and ovations, centralized exchanges still remain a monopoly with security issues. Let’s take a closer look at reasons for Vitalik’s statement.

All centralized crypto exchanges work on the same principle: they accept a user’s deposits on their wallets and allow the user to exchange assets as part of the deposit.

Hence, the user pays a withdrawal fee, the network fee and a service fee.

Since the early days of Bitcoin cryptocurrency market has evolved into a sophisticated multi-blockchain phenomenon. According to coinmarketcap.com statistics, cryptocurrency market contains over 1.5K different currencies with daily exchange turnover of over 14 bln in USD. In addition we should also consider the volumes of intransparent and unregulated peer to peer exchange market as well.

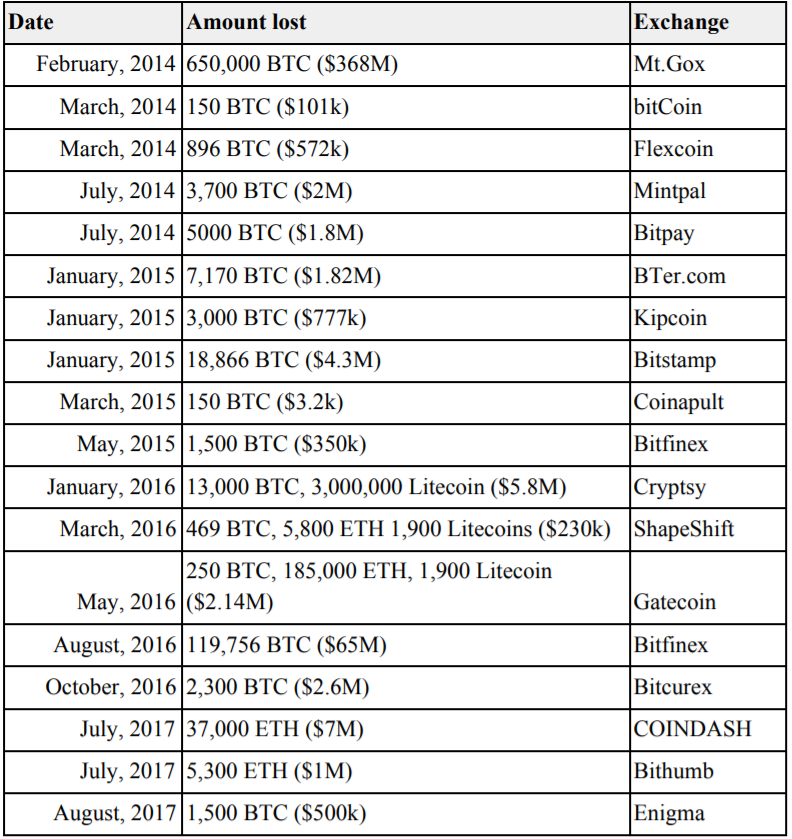

Almost every major exchange has ever experienced security breaches. One of the most disruptive failures was the Mt. Gox exchange collapse. It took a year for the exchange to recover. The list of the publicly known biggest failures of custodian-based centralized crypto exchanges looks impressive for an unprepared spectator:

This list is far from complete, but it gives a good picture of the security level in centralized exchanges. However, the good news is that we all can learn a good lesson and come up with some conclusions: your funds are not safe unless you own your private keys. Anyone can hack and steal them, and this process is irreversible, unfortunately.

As a reaction to the current challenges of the industry Atomic project was created — a convenient and versatile decentralized solution for the custody-free cryptocurrency trading. Atomic Wallet platform is based on a unique proprietary engine specially designed to solve its specific tasks.